UMN research reveals how earth and economy are inextricably linked

New economic model brings Mother Nature to the forefront

Economists at the University of Minnesota are helping to develop a brand-new model to better understand how the earth and economy interact. It’s part of an effort to incorporate the value of nature into the decision-making and policy creation of governments, financial institutions and other organizations. We recently talked with Justin Andrew Johnson, PhD, an assistant professor of Environmental and Natural Resource Economics at UMN, about how the team created the model and what’s next for their research.

What interested you in earth-economy modeling?

It’s been a fascination of mine for 10-15 years to better understand how the economy affects the environment and vice-a-versa. “Earth-economy modeling” is a new term we came up with to describe our work that models how these two systems affect each other. The core group working on this includes researchers from the Natural Capital Project, and economists from UMN and Purdue University. It’s a totally new kind of modeling, and it is exciting to see it catching on.

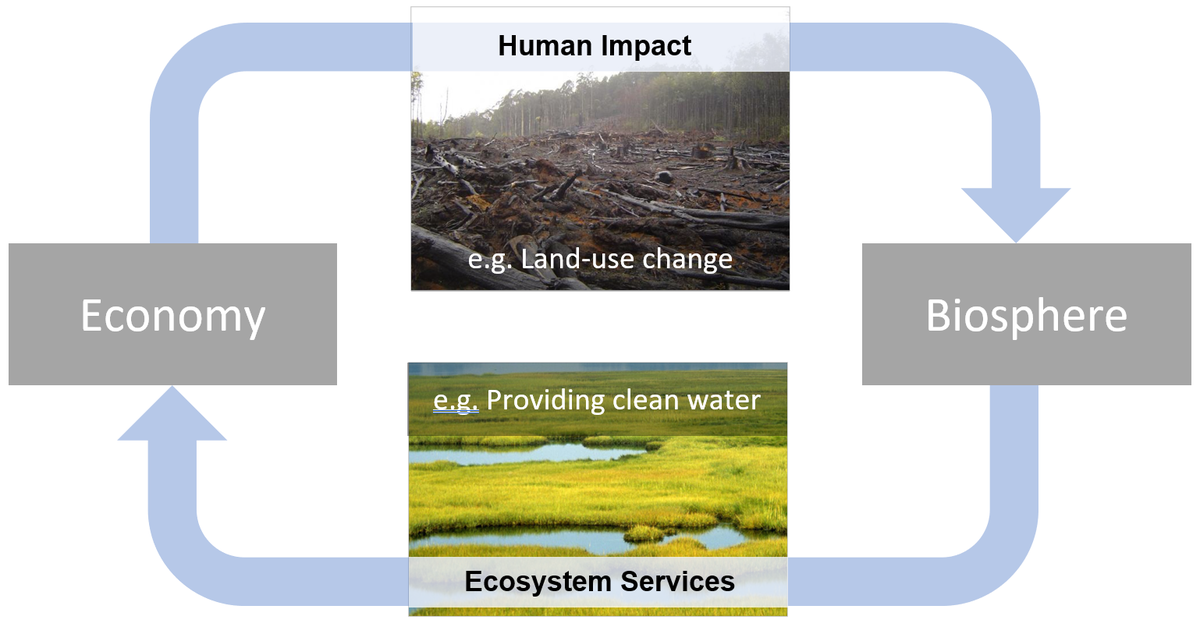

To navigate through sustainability crises, we need to understand how the economy affects the environment, and vice versa. A new "Earth-Economy" model developed in the Department of Applied Economics does this by combining a macroeconomic model with a high-resolution ecosystem service model, generating new insights on what policies are best for both the environment and the economy.

For those unfamiliar with the field, how do you explain what you do?

We are linking earth and economy through models that let both interact. For better or worse, economists in the last century have focused on what they call “general equilibrium theory,” which links the effects of different economic variables and lets changes cascade through the system until it reaches an equilibrium. But the actual general equilibrium models used by policy makers typically leave out the earth, which is a large problem when assessing sustainability challenges. In a sense, we need a more general general equilibrium model. To remedy this, we took one of the most frequently used economic models from the Global Trade Analysis Project (GTAP) and combined it with a framework that calculates the provision of ecosystem services, the Integrated Valuation of Ecosystem Services and Tradeoffs (InVEST) model. Ecosystem services are the many processes by which nature provides valuable things to humans, such as through pollination, coastal protection and carbon storage. Tradeoffs occur when we look at different scenarios, like what happens to agricultural productivity if pollination is disrupted. With our new, combined model, called GTAP-InVEST, we are able to estimate more precisely the monetary value of earth’s natural resources on a global scale. Our estimates, however, are likely a massive underestimate because we are only considering ecosystem services that we can calculate globally and that we understand how they affect the economy.

Why hasn’t this kind of modeling been done before?

Land has been the missing factor up until now. For the better part of the last century, economists have often simplified macroeconomic models to consider only labor and capital, excluding consideration of land as a sperate, unique type of input. Our work brings land back into the equation in a more meaningful way. Here’s why this matters: If a country is expanding its agricultural output, it might do this not just by adding fertilizer and labor to existing farmland; it might do this by bringing new land into production. As crop prices go up, more land is added. Today we can see this land conversion very clearly by satellite, which we include in our model at the 300-meter scale. It’s only in the last few years that we’ve been able to use satellite data to calculate ecosystem services globally, which is why this type of modeling has not been done before. We’re not the first people to think this is important, we’re just the first to look at it on a global scale, at this resolution.

How has your research evolved over the years?

It really took off in 2019 when the World Wildlife Fund (WWF) engaged the Natural Capital Project to assess what happens to the economy when ecosystem services are damaged. In other words, how much harm does it do the economy when we hurt the environment? We came up with an initial model that showed the environment matters to the economy and there are big dollars at risk. The World Bank became interested in our work, but they wanted to extend consideration of specific policies relevant to their bank lending policies. These are policies they use to make decisions on major international development projects. That’s what led us to publish The Economic Case for Nature with the World Bank last year, which presents the new earth-economy model and includes specific recommendations for “nature-smart pillars” that create policies that protect nature’s value and equity. While the model has evolved, we have always looked at it in the context of the United Nations Sustainable Development Goals (SDGs). These are big, bold goals that nations and organizations have committed to support, and yet there aren’t many navigational tools to get us there. We see earth-economy modeling as a tool to help identify which policies are most likely to advance the SDGs.

You mentioned that “nature smart pillars” can help create policies that protect nature’s value and equity. Can you explain how this works?

Sure, I’ll give you an example of a nature-smart policy at the local level. In Central and South America, several cities have started “water funds,” which are payments for ecosystem services to ensure clean drinking water for residents. This means that the cities pay upstream farmers to keep vegetation on their land and adopt other practices to improve water quality downstream. Our model looks at this kind of arrangement on a global scale. For example, could we pay owners of valuable forestland not to convert their land for agriculture? Others have asked this question, but most models don’t ask who’s paying for it and don’t do it at a global scale. Our model proposes a payment mechanism where high-income countries compensate low-income countries based on the amount of land protected from cropland expansion. Then you might ask, would high-income countries be willing to pay? We believe so, because they’ve already made commitments to the SDGs and set clear goals, so this kind of policy is a way to make an impact at scale. It’s why our work with the World Bank is so important. We’re hopeful to soon see some of these nature-smart policies take root at the global level.

What’s next for your research, and what excites you most about the future of this field?

The thing that is most on my mind is making the model more dynamic. I’d like to be able to assess tipping points so we can understand what happens to the economy if we experience specific environmental scenarios. It’s also important that we add more country-level details to the model because a lot of these policy decisions are happening at the national level. What encourages me is that all of our findings show that investing in ecosystem services greatly benefits low-income countries. They rely on nature the most, and when you protect nature, they also benefit the most.

This is a 20-year research agenda, with many graduate and post-doctorate students at the University of Minnesota taking part in the work. It’s a growing area of research, with a lot of interest and enthusiasm. I would encourage anyone who is interested, including undergraduate students, to check out the Natural Capital Project and the Department of Applied Economics and look for ways to get involved.

Justin Andrew Johnson is an assistant professor in the Department of Applied Economics at the University of Minnesota’s College of Food, Agricultural and Natural Resource Sciences. He is also a lead scientist at the Natural Capital Project, a 12-year partnership between the University of Minnesota, the Chinese Academy of Sciences, The Nature Conservancy, Stanford University, the Stockholm Resilience Center and the World Wildlife Fund.